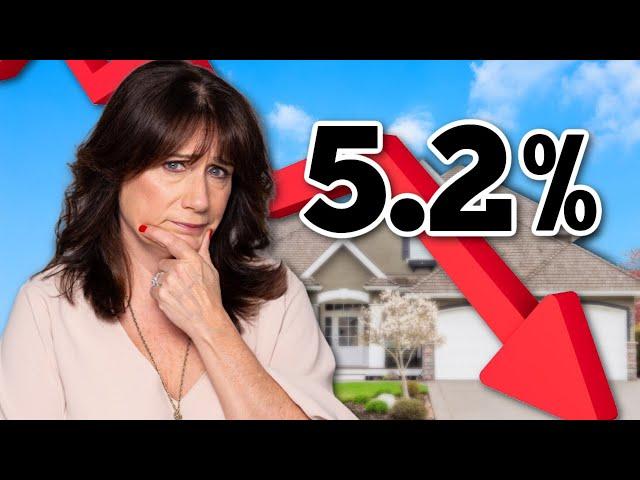

Mortgage rates are going DOWN in 2023? Here is what the experts are saying.

Комментарии:

The recent data of house inventory plummeting is concerning. I think is the data provided by Fred. Many other sources are already sounding the alarm of possible bid wars even though apr is high.

We are at 2.5 month inventory as we speak with the 4 percent drop and the hot market in 2021 was less than a month if I recall.

I miss you Ty

Ответить

I agree with the comments that buyers are experiencing fatigue and low morale with the housing market. Dare I say we have been through it. You need energy and enthusiasm to go into bidding wars otherwise people are like this is my offer take it or leave it, if it doesn't work I will continue living wherever I am at. Housing affordability is what people care about it at the end of the day- what percentage of my paycheck is going to the mortgage every month. Looking forward to lower rates! A bit of hope and sunshine in this murky market. Lowering the rates may not be enough to start paying over asking

Ответить

Keep dreaming . Inflation doesn’t get under control in a year . I see increases in rate not decreases

Ответить

😂😂😂😂😂😂

Ответить

People are stacking their cash waiting to put 150K down on a house...its gonna be a mess until there is significant inventory increases

Ответить

Fully agree with Neda's POV and also please look to Barry Habib for mortgage forecasts. He has been a solid beacon in the last two decades on rate movements also explaining why the spread (3yr FRM vs. 10 yr treasury) recently moved from 200 to 300 bps which is why rates shot to over 6%.

Ответить

These rates are ridiculous! BUT I’m still gonna buy 😅

Ответить

we need more inventory! I am looking specifically in Wayne and the inventory levels is terrible. Lost out on 2 houses in the past couple months to bidding wars.

Ответить

New to your channel. Nice to see someone talk about NJ which is often neglected. Affordability or lack thereof is a huge problem. Thanks for the videos and the info.

Ответить

why is this still happening in NJ ? i've been looking in Morris county Montville and some other towns. homes i see in Randolph going for high 700s now were mid 500s or high 500s. just before the pandemic. i understand when the rates were low but their not now.

Ответить

They are changing the inflation calculation to lower inflation, even though it is fake. This will provide coverage to allow more printing.

Ответить

Interest rates are incredibly high. I'm so thankful I bought my house 2 years ago. We got it at 2.8%. Now it's near 7%??

Do we ever learn?

I bought a vehicle in 2018. The Interest rate was 3%

I bought a truck yesterday, guess what. Interest is now 6.9%.

What's the plan? Vote Biden in again?

Hey fuckturds. I like my 3.5 a lot better then your 5 plus and your ignoring what you like is a prediction and right now there6.5. So. You are todays number one fuckturd.

Ответить

The overbidding is wrong. These still get appraised... Borrowers ALWAYS pay over Appraisal in CASH. The bank WILL NOT lend over appraisal..

Ответить

This didn’t age well. 6.94 3/1. We will be over 7 by next week

Ответить

7% as of 3/1/2023 here in TX....

Ответить

These rates are not high historically. The average 30 year mortgage rate over the last 30 plus years (1971 to present) is 7.75%. My first home in 1991 was 9.5%. The days of free money are over folks - you'll probably never see a rate under 5% again. There are many reasons for this but it's mostly demographics. Marry the house and date the rate. If rates go down you can always refi.

Ответить

I think also the number of mortgages now at 3% or less is going to play havoc with housing availability. Marginal sellers to going to stay put for years to come.

Ответить

You were wrong!!!! Interest rates are passing 7 percent. Unsubscribe

Ответить