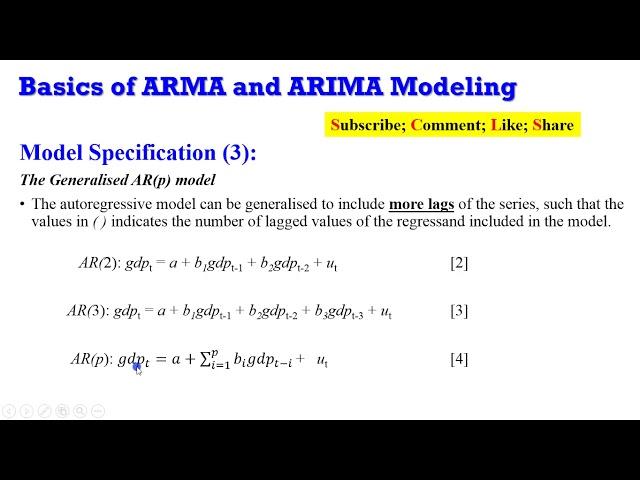

Basics of ARMA and ARIMA Modeling #arima #arma #boxjenkins #financialeconometrics #timeseries

ARMA/ARIMA is a method among several used in forecasting variables. Uses the information obtained from the variables itself to forecast its trend. The variable is regressed on its own past values. Based on univariate analysis. Knowing and analysing the probabilistic, or stochastic, properties of variables. Designed to forecast future movements. Uses the philosophy “let the variable speak for itself”. This concept is very relevant because it helps investors, government regulators, policy makers and relevant stakeholders take informed decision. In essence, information relating to the series are obtained from the series itself. The Box-Jenkins type time series models allow Yt to be explained by past, or lagged, values of Y itself and stochastic error terms (innovations or shocks). For this reason, ARMA models are sometimes called atheoretic models because they are not derived from any economic theory. The series is simply explaining itself using its historical data. ARMA is composed of two distinct models which explains the behaviour of a series from two different perspectives: the autoregressive (AR) models and the moving average (MA) models. We will also show that these models move in opposite directions of one another. Distinction between ARMA and ARIMA is the integration component which brings us back to the subject of stationarity. In reality, most economic variables are non-stationary hence they have to go through a transformation process called differencing before they become stationary. The transforming process is also called integration. So ARIMA informs the researcher or reader that the series in question has gone through an integration process before being used for any analysis. Hence, the moment a nonstationary variable is differenced before becoming stationary, such is known as an integrated variable. Since the essence of engaging an ARIMA model is to forecast a series, the B-J methodology uses four steps: identification, estimation, diagnostics and forecasting.

Follow up with soft-notes and updates from CrunchEconometrix:

Website: http://cruncheconometrix.com.ng

Blog: https://cruncheconometrix.blogspot.com.ng/

Forum: http://cruncheconometrix.com.ng/blog/forum/

Facebook: https://www.facebook.com/CrunchEconometrix

YouTube Custom URL: https://www.youtube.com/c/CrunchEconometrix

Stata Videos Playlist: https://www.youtube.com/watch?v=sTpeY31zcZs&list=PL92YnqQQ1gbjyoGWR2VUemNPU93yivXZx

EViews Videos Playlist: https://www.youtube.com/watch?v=znObTs4aJA0&list=PL92YnqQQ1gbghRSJURtz08AZdImbge4h-

Follow up with soft-notes and updates from CrunchEconometrix:

Website: http://cruncheconometrix.com.ng

Blog: https://cruncheconometrix.blogspot.com.ng/

Forum: http://cruncheconometrix.com.ng/blog/forum/

Facebook: https://www.facebook.com/CrunchEconometrix

YouTube Custom URL: https://www.youtube.com/c/CrunchEconometrix

Stata Videos Playlist: https://www.youtube.com/watch?v=sTpeY31zcZs&list=PL92YnqQQ1gbjyoGWR2VUemNPU93yivXZx

EViews Videos Playlist: https://www.youtube.com/watch?v=znObTs4aJA0&list=PL92YnqQQ1gbghRSJURtz08AZdImbge4h-

Тэги:

#arma_model_eviews #arma_stata #arima_forecasting_model #arma_forecast_in_stata #how_to_estimate_arma #how_to_estimate_arima_diagnostics_eviews #arima_models #box-jenkins #acf_eviews #pacf_eviews #arimКомментарии:

Day 2/2 away

Farrilexis queen

Ghost Recon Breakpoint: трейлер "Мировая угроза"

Ubisoft Россия

Top Ten Cufflinks To Complete Your Look

Awesome Stuff 365

My Little Pony Дружба — это чудо сезон 1 | Серия 25-26 | MLP FIM по-русски

My Little Pony Россия - официальный канал

HOVO - Heqiat

OLD ARMENIA

Strange Unexplained Internet Videos

BE AMAZED