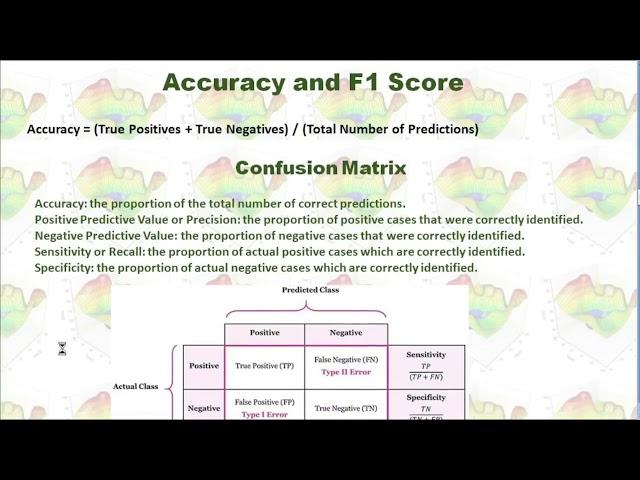

Credit Risk Modeling in Python (Part 2) (Modeling)

Credit risk refers to the potential loss that a lender or investor may face due to the inability of a borrower to fulfill their financial obligations.

Credit risk is a fundamental concept in the world of finance and lending, and managing it effectively is crucial for maintaining the stability and health of financial institutions and markets.

Credit risk modeling is a process used by financial institutions and lenders to quantify and assess the potential credit risk associated with lending money or extending credit to borrowers.

It involves using statistical and mathematical techniques to predict the likelihood of a borrower defaulting on their financial obligations.

I used the dataset I explained in my previous video and built credit risk models.

Then I evaluated and validated the models.

You are welcome to provide your comments and subscribe to my YouTube channel.

The Python code is uploaded into https://github.com/AIMLModeling/CreditRiskModel

Credit risk is a fundamental concept in the world of finance and lending, and managing it effectively is crucial for maintaining the stability and health of financial institutions and markets.

Credit risk modeling is a process used by financial institutions and lenders to quantify and assess the potential credit risk associated with lending money or extending credit to borrowers.

It involves using statistical and mathematical techniques to predict the likelihood of a borrower defaulting on their financial obligations.

I used the dataset I explained in my previous video and built credit risk models.

Then I evaluated and validated the models.

You are welcome to provide your comments and subscribe to my YouTube channel.

The Python code is uploaded into https://github.com/AIMLModeling/CreditRiskModel

Тэги:

#Python #Credit_Risk_Modeling #Credit_Risk #Machine_Learning #Logistic_Regression #Binary_Classification #Softmax_Regression #Precision #Recall #Accuracy #F1_Score #Confusion_Matrix #Sensitivity #Random_Forest_Classifier #XGBoost_Classifier #Extreme_Gradient_Boosting #Cross-validation #Cross_ValidationКомментарии:

Credit Risk Modeling in Python (Part 2) (Modeling)

Statistics and Risk Modeling

Да Я мать и я умею танцевать. Выпускной 2019. Мамы зажгли)

Aigul Nurahmetova

Sonoma County’s Approach to CTE and Pathways

Getting Smart

Ayçin İnce Full Meme Göründü Frikik

Words Video

РЕАЛИСТИЧНЫЙ СИМУЛЯТОР СПЕЦНАЗА ( Ready or Not )

perpetuumworld

Schwerer Panzer

Neo Vin Knauer

The BEST Way to Use A.I. to Create Your Website

Wes McDowell