The Repo Market Explained

While banks can raise funds from deposits and securitizations, they can also access short-term funds through the repo market.

In the repo market, organizations sell securities with an agreement to repurchase them at a higher price in the future (in many cases, they agree to repurchase the securities the next day).

The seller of the securities is known as the repo side, whereas the buyer of the securities is known as the reverse repo side.

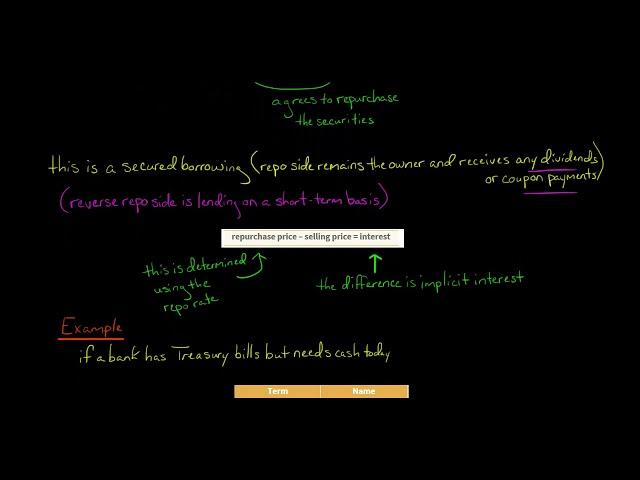

The repo side is essentially executing a secured borrowing, while the reverse repo side is lending funds on a short-term basis.

The repo market is usually highly liquid and the cost of borrowing is low. This makes it a popular way to raise short-term funds. The repo term can be for a single trading day or multiple days; in some cases, it doesn’t have a set term.

Single trading day = overnight repo

Multiple trading days= term repo

No set term = open repo

Thus, if a bank has securities (e.g., Treasury bills) but it needs cash today, it can sell the securities with an agreement to repurchase them the next day.

The repo side (the borrower) remains the owner of the security and gets any coupon payments or dividends attributed to the security.

The reverse repo side (the lender) profits by selling the securities back to the repo side at a higher price. The difference between the selling price and the repurchase price is implicit interest:

repurchase price – selling price = interest

The repurchase price (and hence the interest) is determined using the repo rate.

If the repo side can’t come up with the funds to execute the purchase, the reverse repo side can take possession of the securities and liquidate them to ensure repayment. However, there is a risk the securities will have declined in value and the reverse repo side won’t be able to recover the amount they lent. For this reason, the reverse repo side won’t lend the full amount of the securities’ value. The difference between the value of the securities and the amount of cash lent is called a haircut:

cash lent – value of security = haircut

The repo market is used by banks, mutual funds, hedge funds, pension funds, etc.

In the U.S., the repo market is also used by the Federal Reserve as part of its open market operations.

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* http://eepurl.com/dIaa5z

—

SUPPORT EDSPIRA ON PATREON

*https://www.patreon.com/prof_mclaughlin

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* https://edspira.thinkific.com

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725

* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc

* Website: https://www.edspira.com/podcast-2/

—

GET TAX TIPS ON TIKTOK

* https://www.tiktok.com/@prof_mclaughlin

—

ACCESS INDEX OF VIDEOS

* https://www.edspira.com/index

—

CONNECT WITH EDSPIRA

* Facebook: https://www.facebook.com/Edspira

* Instagram: https://www.instagram.com/edspiradotcom

* LinkedIn: https://www.linkedin.com/company/edspira

—

CONNECT WITH MICHAEL

* Twitter: https://www.twitter.com/Prof_McLaughlin

* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin

—

ABOUT EDSPIRA AND ITS CREATOR

* https://www.edspira.com/about/

* https://michaelmclaughlin.com

In the repo market, organizations sell securities with an agreement to repurchase them at a higher price in the future (in many cases, they agree to repurchase the securities the next day).

The seller of the securities is known as the repo side, whereas the buyer of the securities is known as the reverse repo side.

The repo side is essentially executing a secured borrowing, while the reverse repo side is lending funds on a short-term basis.

The repo market is usually highly liquid and the cost of borrowing is low. This makes it a popular way to raise short-term funds. The repo term can be for a single trading day or multiple days; in some cases, it doesn’t have a set term.

Single trading day = overnight repo

Multiple trading days= term repo

No set term = open repo

Thus, if a bank has securities (e.g., Treasury bills) but it needs cash today, it can sell the securities with an agreement to repurchase them the next day.

The repo side (the borrower) remains the owner of the security and gets any coupon payments or dividends attributed to the security.

The reverse repo side (the lender) profits by selling the securities back to the repo side at a higher price. The difference between the selling price and the repurchase price is implicit interest:

repurchase price – selling price = interest

The repurchase price (and hence the interest) is determined using the repo rate.

If the repo side can’t come up with the funds to execute the purchase, the reverse repo side can take possession of the securities and liquidate them to ensure repayment. However, there is a risk the securities will have declined in value and the reverse repo side won’t be able to recover the amount they lent. For this reason, the reverse repo side won’t lend the full amount of the securities’ value. The difference between the value of the securities and the amount of cash lent is called a haircut:

cash lent – value of security = haircut

The repo market is used by banks, mutual funds, hedge funds, pension funds, etc.

In the U.S., the repo market is also used by the Federal Reserve as part of its open market operations.

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* http://eepurl.com/dIaa5z

—

SUPPORT EDSPIRA ON PATREON

*https://www.patreon.com/prof_mclaughlin

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* https://edspira.thinkific.com

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: https://podcasts.apple.com/us/podcast/scheme/id1522352725

* Spotify: https://open.spotify.com/show/4WaNTqVFxISHlgcSWNT1kc

* Website: https://www.edspira.com/podcast-2/

—

GET TAX TIPS ON TIKTOK

* https://www.tiktok.com/@prof_mclaughlin

—

ACCESS INDEX OF VIDEOS

* https://www.edspira.com/index

—

CONNECT WITH EDSPIRA

* Facebook: https://www.facebook.com/Edspira

* Instagram: https://www.instagram.com/edspiradotcom

* LinkedIn: https://www.linkedin.com/company/edspira

—

CONNECT WITH MICHAEL

* Twitter: https://www.twitter.com/Prof_McLaughlin

* LinkedIn: https://www.linkedin.com/in/prof-michael-mclaughlin

—

ABOUT EDSPIRA AND ITS CREATOR

* https://www.edspira.com/about/

* https://michaelmclaughlin.com

Тэги:

#repo_market #what_is_the_repo_market #repo_market_explained #what_is_a_repurchase_agreement #repo_agreement #what_is_a_repoКомментарии:

The Repo Market Explained

Edspira

경희순간4K|메리 크리스마스️ 아름다운 경희대학교 서울캠퍼스 겨울 타임랩스

경희대학교 Kyung Hee University

MASE LEBIH VIRAL MALU KETAHUAN WIKWIK

ANTI MUMET C_Channel

roseboi - HIDAN (Official audio)

Rhymes Music

Dwaraka - The Submerged City in Sea! Amazing India - Art of Living

Art Of Living Kozhikode