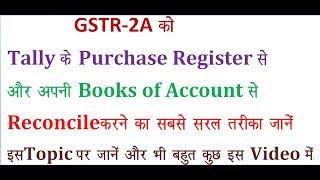

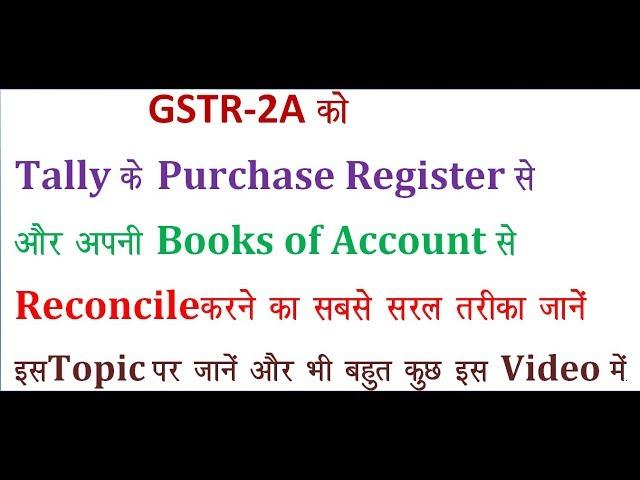

how to reconcile GSTR2A From tally/books of account/gstr2a ko tally se kese match kare

Комментарии:

Thanku sir

Ответить

Sir aap se request hai ki aap educational version me koi video na banaye ....plz

Ответить

Gjb

Ответить

Very good with simple language

Ответить

nice

Ответить

Sir agar hum 500 invice h ek sath reconcile nhi hu sakti h sab

Ответить

Sir aapka samjane ka tarika bahut hee achha h

Ответить

Sir how can I return file of gst directly from tally erp 9

Ответить

Sir apaka samjane tarika bahut achha he. U r great

Ответить

Sir, your video is really awesome I am grateful to you. Sir how to put figure in 3B on GST portal from Tally.

Ответить

I have learn lot of knowledge form your valuable video. But, Sir create some video on tour operator service provider sale their ticket from online on e-commerce portal. The E- commerce operator raised their commission bills every two or three days after all deduction and last they raised a monthly consolidated bill. Sir, Still I don't understand their bills entry in tally. Please Sir if you can help me I will very grateful to you. Thanking you and assuring you of your best co-operation at all times.

Ответить

Sir pls ap apna number de skte h kya

Mujhe apse kuch dought clear krne h

Payroll k bare me

sir air video banayeye

Ответить

Sir Ji Wish you very happy new year 🎉🎁🎶

Ответить

Agr ek hi empolae ko kitna sel Kiya kitna purchase Kiya h to ek sath sb kaise check krte h

Ответить

Good morning sir

Ответить

Sir Namaskar,

Aap ek video GST practitioner ke bare mein banaen jismein uski Puri jankari mile aur ham usi kaise kar sakte hain jise Ham apna bhavishya ujjwal banaen

Dhanyvad

Sir ek bill ka payment two other person karte hai to uska bill kaise banaye

Ответить

Sir balance sheet par video banao ji

Ответить

Sir Namaskar

Aap kaise hain, sir aap se mujhe tally main kuchh puchna hai

Next video kab aayga

Ответить

Sir kisi window & door factory me accounting kaise kr skte hai is subject pr ek video bana digiye please

Ответить

सर अगर कोई लेबर अपने सिर पर बोरी लेकर लोड और अनलोड करता है जो कि पर बोरी का रेट 3 रुपया है तो उसको किस लेजर में एंट्री करेंगे प्लीज़ सर इस पर कोई वीडियो बनाये

Ответить

Sir mai jaipur me job karta hu 30 party ke kaam ko handel karta hu. Sir mere pass dairy ke kaam dhood dairy ke kaam hai sir uska ledger balance ko match karne me kafi problem hota hai

Ответить

Sir aur gstr 9 me bhi problem create karna padta hai

Ответить

Thanku so much sir..you r great teacher..

Ответить

Very nice , easy trick sir.

Ответить

Jo itc expense mein liya h wo thodi purchase register mein reflect hoga

Ответить

Agr wo gstr 11 December tk bharega jo ki last date hai toh humein bhi toh file krna padega 11 tk toh fr sahi itc kaise claim kr payenge

Ответить

please sir creditors ka reconciliation kese kare please bataiye sir

Ответить

Sir, GSTR 2A Ko GST No. Se reconcile Kar Sakte Hai? Pls, Co. 9879619122 Jignesh

Ответить

Meri sabhi quiries solve ho gae. Thanku so much for this useful explanation🙂👌

Ответить

Thank you sir Please tell us reconcile tally with gst portal by Excel spreadsheet

Ответить

Wow sir. Explain very well

Thanks

Thank you sir.aap ke Vides se mujhe Bahot help milti he or aap ka explain karne ka tarika Bahot badhiya he

Ответить

None of channel can compare of this channel. You did explain everything. Such you are a great teacher. Thanks a lot sir 😊

Ответить

Namaste sir, sir m apki vedios se kafi help le raha hu accounting work karne me, sir mera ek question hai apse plz ans den sir.

Sir question ye hai ki gstr2A reconcile karte waqt kuch invoive aisi aa sakti hain jo supplier ne gstr1 me show nahi ki lekin hamari tally me gst reports me wo invoice hai kyuki humne maal purchase kiya hai, to is condition me hum iska ITC nahi le sakte kyuki supplier me gstr1 me ye invoice show nahi kiya, to sir is month ki gstr 3b hum kaise file karen or tally me gst report me is invoice ka effect khatam kaise karen.

Sir Gstr2b ki video banaye

Ответить

best video

Ответить

Very useful

Ответить

Very good

Ответить

great sir

Ответить

Grear clarifications 👍👍

Ответить

Sir wheat mungfali etc k khared bikri (galle / meal) k accounting kese kre please video banye 🙏

Ответить

thank u very much sir , please esi hi playlist TDS ke upar bhi banaye, i think everyone wants complete package

thanks

God Bless u :)

Excellent sir 👌👌👌

Sir aap real mai hi har subject ke bare mai bahut ache se samjhate ho

O

Ответить